(2022) A Level H2 Econs Essay Q2 Suggested Answer by Mr Eugene Toh (A Level Economics Tutor)

(2022) A Level H2 Econs Paper 2 Essay Q2

Disclaimer: The answers provided on our website is a 'first draft outline’ version of the answers provided for your convenience.

For the full, finalised answers, please click here to purchase a hard copy of the Comprehensive TYS Answers authored by Mr Eugene Toh and published by SAP. (The page might take awhile to load)

Search for “COMPREHENSIVE ANSWERS TO A LEVEL H2 ECONOMICS YEARLY EDITION” or “9789813428676” to purchase.

2. The Singapore government announced in the 2018 Budget that the goods and services tax (GST) would rise from 7% to 9% sometime between 2021 and 2025. The intended consequence of this change is to raise tax revenue. However, following the coronavirus (Covid-19) outbreak in 2020, the incomes of many households fell.

(a) With the aid of diagrams, explain why an increase in GST and a fall in the incomes of many households are each expected to cause a fall in expenditure on luxury goods. [10]

Introduction

Define price elasticity of demand: mesures the degree of responsiveness of quantity demanded of a good to a change in price of the same good, ceteris paribus

Define income elasticity of demand: measures degree of responsiveness of demand of a good to a change in income levels of consumers demanding for the good, ceteris paribus.

Explain the demand for luxury goods such as cars (in context of SG) or luxury handbags (Chanel/Gucci/Prada) are both price elastic (due to low degree of necessity / high % of income) and income elastic (luxury goods)

Increase in GST

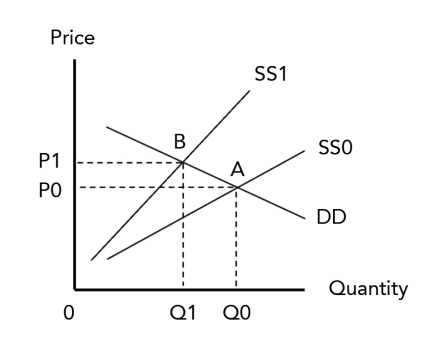

An increase in GST would lead to an increase in cost for producers (GST is eventually payable to the goverment by the producer) → increase in cost of production → decreased supply → supply shift to the left from SS0 to SS1 → increase in price from P0 to P1 (an ad valorem tax such as the GST will see supply having a pivoted shift to the left)

Given that demand for luxury goods are price elastic since they take up a large proportion of an average person’s income (a Chanel handbag can cost $$6000), there will be a more than proportionate fall in quantity demanded from Q0 to Q1.

This will lead to a fall in expenditure on luxury goods from 0P0AQ0 to 0P1BQ1.

Fall in Incomes of Households

A fall in income levels of consumers will result in a fall in purchasing power of consumers → this will lead to a fall in demand for luxury goods from DD0 to DD1.

As demand for luxury goods is income elastic, the fall in demand will likely be more than proportionate.

This will lead to a large fall in expenditure for luxury goods from 0P0AQ0 to 0P1BQ1.

Conclusion

Increase in GST and fall in incomes of many households will each lead to a fall in expenditure on luxury goods.

(b) Discuss whether this increase in GST is likely to raise tax revenue and whether it will lead to unintended consequences. [15]

Likely to Raise Tax Revenue

GST is collected as a % of what is spent on goods and services. In this case, an original 7% was collected as a % of what is spent on goods and services, and now we see an increase in GST to 9% of what is spent on goods and services.

An extra 2% is collected on goods and services, but if total expenditure spent on goods and services were to fall as a result of prices going up, then we will need to consider that the loss in tax collections caused by higher prices (as a result of the GST increase) is greater than the extra 2% collected on the total expenditure.

We can broadly categorise the 2 types of goods that consumers would spend on to necessities and luxury goods.

We have analysed that the demand for luxury goods would fall as a result of the GST increase → total expenditure for luxury goods will likely fall based on our answer in (a) → tax collections from luxury goods will thus likely fall.

We now need to also analyse what would happen to demand for necessities as a result of the GST increase.

Demand for necessities are price inelastic (high degree of necessity) → an increase in price as a result of the GST increase will result in a less than proportionate decrease in quantity demanded for such a good → total expenditure on necessities will increase → tax collections from necessities will likely increase.

Given that the total spending on necessities by consumers would likely far exceed the total spending on luxury goods in general → the total tax collections will still see an increase.

Evaluation:

We could further segregate that spending on luxury goods by the general population may decrease but by higher income earners, these may be considered mroe of a necessity than a luxury good → total expenditure by high income earners on luxury goods may rise instead.

Unintended Consequences

Consumes may bring purchases forward:

To avoid paying more for GST, consumers may consider bringing forward purchases of goods and services ahead of the GST increase, especially in the case of large ticket items. Many consumers were observed to be making advanced purchases in December 2022 to avoid the GST hike which was set to kick in 1 January 2023.

Tax avoidance:

As the GST increases, many will be more incentivised / inclined to not declare / under declare the GST payable for the goods and services purchased. This can be especially for goods purchased over the internet. This will result in a loss in tax revenues.

Lower income earners may be more badly affected than high income earners: GST on its own is considered to be a regressive tax; low income earners pay a larger % of their income towards GST as compared to high income earners. This is because spending on goods and services take up a larger proportion of a low income earner’s income compared a to higher income earner. The GST increase will thus have a bigger impact in terms of tax incurred as a proportion of income. The government can / has resolved this by effecting income transfers through GST vouchers / Workfare Income Supplement to reduce the regressiveness of GST as a tax.

Found our TYS answers useful?

Maximise your A-Level H2 Economics preparation with the ETG A-Level H2 Economics TYS Crashcourse! Perfect for students looking to enhance their skills in both essay and case study analysis, this comprehensive 3-day crashcourse will cover over 60 essay questions and 20 case studies from the A-Level Economics Ten-Year Series. Whether you're attending onsite or via Zoom, our experienced tutors will guide you through the intricate demands of H2 Economics, offering expert feedback and graded answers. For the best economics tuition in Singapore, sign up now to secure one of the limited onsite seats!